The Science Behind Quantly

Why Quantly Rates Stocks

We believe in value investing—a philosophy developed by Benjamin Graham and used with great success by Warren Buffett.

Value investing is based on the principle that a stock should only be bought below its fundamental value in order to achieve superior returns. The challenge for investors of all types: how to exactly identify the fundamental value?

Our system uses data science to find undervalued stocks and rank them based on probability of movement. It uses options data and technical analysis to identify timing to enter into a position and optimal options strategy for rebalancing, to maximize profit from market volatility.

How Quantly Rates Stocks

Quantly’s data scientists have built a proprietary algorithmic engine—honed over more than 15 years—that enables us to rank stocks and forecast stock movement based on a range of factors.

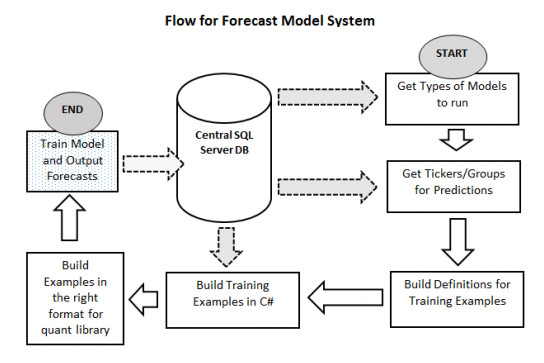

Behind this engine is our Forecast Model System—a logistic regression model that trains itself to predict the probability that a given stock will rise in value after 14, 30 and 60 days (or other timeframes). A central database dictates which tickers, other models and types of data are used for the predictions. Our system considers variables including long-run earnings per share growth, stock volatility, beta, correlation between the S&P 500 Index (SPX) and the stock and other factors.The model’s output maps to a Quantly score of 1 – 5, with 1 representing 0-20% probability of an increase in value, and 5 representing 81-100% probability of an increase in value. This value correlates with Quantly’s Short Term Trend rating—i.e the expected stock price performance—bullish or bearish—based on the time horizon provided.

We additionally provide a Long Term Rating for each opportunity identified. This value/momentum score, based on a scale of 1-10 (with 10 being the most favorable expected risk and return outlook), conveys the long-term outlook (1-5 year horizon) Quantly has assigned based on our proprietary algorithm and technical and fundamental analysis.

In tandem, Quantly uses these ratings to help you find stocks with the highest statistical likelihood of providing a positive return on investment, based on the investment criteria you provide.

How We Built The Quantly Algorithm

1. Determine what data provides the best features for forecasting stock movement

To accomplish this, we used logistic regression because

- We believe it is the most effective machine learning technique.

- It measures bias and variance to assess whether or not the model is a good predictor.

In this phase of work, we collected different types of data and fed it through an optimizer to “train” the model and determine the best weights to put on each data type to get the most accurate predictions. The data is in the form of .csv text files, with each row of a file representing a set of data features.

Optimization math can be complex. Luckily, the tools available abstract away this complexity and simply return the model’s weights for analysis. If you’re interested in the detail, we welcome you to contact us.

2. Validate the model

We trained the model on 60% of the data collected (an industry standard) and used the remaining data for validation/calibration.

Validation data is used to see how the model performs on data outside of the sample it trained on. Using this data, we construct learning curves, which contrast the accuracy of predictions using data inside and outside of the training set to determine if the model suffers from high bias (it’s not a good predictor) or high variance (it’s curve-fit to the data). Based on these results, we determine how to improve the algorithm by adding more training data or by trying new combinations of data features.

Quantly continually validates and recalibrates its model to ensure precision.

3. Analyze performance

Ultimately, we evaluated the best performance the model was able to achieve on the test data and what data features and weights were used. Based on results indicating predictive precision, we ramped up the Quantly model to a neural network—a powerful but more involved machine learning technique—and ultimately launched our cloud-based platform to make our algorithms accessible to every professional portfolio manager and self directed investor.

Our algorithms have now been honed over more than 15 years based on continuous learning and performance.